Excitement About Mortgage Broker In Scarborough

Wiki Article

Excitement About Mortgage Broker

Table of ContentsAn Unbiased View of Scarborough Mortgage BrokerMortgage Broker In Scarborough - QuestionsNot known Facts About Mortgage BrokerMortgage Broker Scarborough Fundamentals ExplainedTop Guidelines Of Mortgage Broker ScarboroughThe Main Principles Of Scarborough Mortgage Broker Mortgage Broker for DummiesThe Greatest Guide To Mortgage Broker Scarborough

You're a little anxious when you first come to the home loan broker's office. You need a residence loan Yet what you truly want is the residence. The lending is simply entering your way. Perhaps you have actually already located your desire home, or possibly you're being available in with a basic concept of the sort of home you want In any case, you need advice.The home loan broker's task is to recognize what you're trying to attain, work out whether you are ready to leap in currently and also after that match a lender to that. Before chatting concerning lenders, they need to collect all the info from you that a financial institution will need.

The Ultimate Guide To Mortgage Broker Near Me

A major change to the industry occurring this year is that Home mortgage Brokers will certainly have to follow "Ideal Interests Obligation" which suggests that lawfully they have to place the customer. Interestingly, the banks do not have to abide with this brand-new guideline which will benefit those customers making use of a Home loan Broker much more.It's a mortgage broker's job to help get you prepared. Maybe that your savings aren't fairly yet where they must be, or maybe that your revenue is a little bit suspicious or you've been freelance as well as the banks need more time to assess your scenario. If you're not yet ready, a home loan broker exists to furnish you with the knowledge and also recommendations on how to enhance your position for a loan.

How Scarborough Mortgage Broker can Save You Time, Stress, and Money.

Home loan brokers are storytellers. Their task is to paint you in the light that gives you the best possibility of being accepted for a funding. They're specialists at connecting the 'why' to the lending institution. They address the inquiry: 'Why should we authorize this loan?' So. The lending institution has authorized your funding.Your house is yours. Written in partnership with Madeleine Mc, Donald.

The Ultimate Guide To Mortgage Broker Scarborough

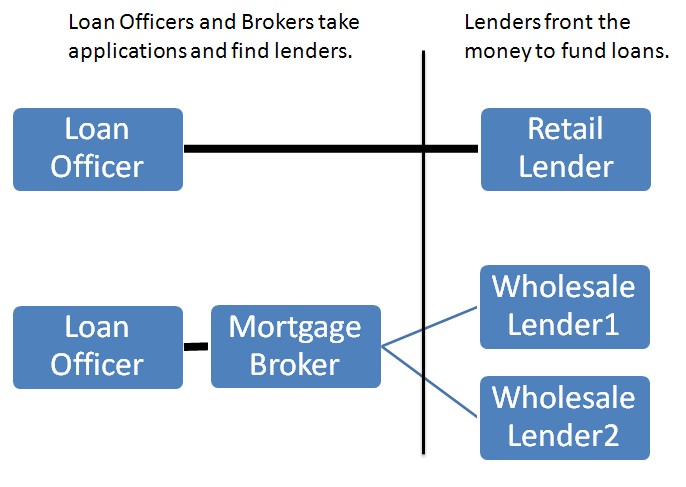

They do this by contrasting home loan products provided by a variety of lending institutions. A home loan broker acts as the quarterback for your financing, passing the sphere between you, the consumer, and also the lender. To be clear, home mortgage brokers do a lot more than aid you obtain an easy home mortgage on your house.

When you go to the bank, the financial institution can just offer you the services and products it has readily available. A financial institution isn't most likely to inform you to drop the road to its rival who provides a home loan item better suited to your needs. Unlike a financial institution, a mortgage broker commonly has partnerships with (oftentimes some loan providers that do not directly deal with the general public), making his chances that much better of finding a lender with the best home loan for you.

Fascination About Mortgage Broker Near Me

If you have actually already made an offer on a residential or commercial property as well as it's been approved, your broker will certainly submit your application as a live deal. When the broker has a mortgage commitment back from the loan provider, he'll discuss any type of conditions that require to be satisfied (an appraisal, evidence of income, proof of down settlement, etc). mortgage broker Scarborough.

Excitement About Mortgage Broker Near Me

This, in a nutshell, is exactly how a mortgage application functions. Why make use of a home loan broker You may be asking yourself why you should make use of a home mortgage broker.Your broker needs to be well-versed in the mortgage products of all these loan providers. This indicates you're a lot more likely to discover the most effective mortgage item that fits your needs. If you're an individual with damaged credit report or you're getting a home that remains in less than outstanding problem, this is where a mortgage broker broker can be worth their weight in gold.

How Mortgage Broker Scarborough can Save You Time, Stress, and Money.

/mortgage-broker-3b0953175a7e4d90b99e937b79e0cd14.jpg)

Make sure to ask your broker exactly how numerous loan providers he deals with, as some brokers have access to even more lenders than others and might do a greater volume of business than others, which suggests you'll likely obtain a far better price. This was a review of working with a home mortgage broker (mortgage broker Scarborough).

Not known Facts About Mortgage Broker In Scarborough

85%Promoted Price (p. a.)2. 21%Comparison Price (p. a.) Base standards of: a $400,000 lending quantity, variable, fixed, principal and also interest (P&I) home mortgage with an LVR (loan-to-value) proportion of at the very least 80%. Nevertheless, the 'Contrast House Loans' table enables computations to made on variables as selected as well as input by the user.The option to using a home loan broker is for people to do it themselves, which is sometimes referred to as going 'direct'. A 2018 ASIC survey of customers who had actually obtained a car loan in the previous 12 months reported that 56% went direct with a lender while 44% went through a mortgage broker.

Report this wiki page